Are you considering moving to Colorado and wondering if it is an affordable place to live? This comprehensive guide will take an in-depth look at the various factors that contribute to the cost of living in Colorado.

- Is Colorado an affordable place to live?

- Examining the various factors that contribute to the cost of living in Colorado

- The impact of housing costs on the overall cost of living in Colorado

- How does the cost of food and groceries in Colorado compare to other states?

- Transportation costs: Can you save money by using public transport in Colorado?

- Utilities and energy costs: What you need to know before moving to Colorado

- Taxes in Colorado: An overview of how they affect the cost of living

- Healthcare expenses: Are they higher or lower than the national average?

- Understanding how your income level affects your cost of living in Colorado

- Cost comparisons between major cities in Colorado

- Why do some people find it difficult to afford living in Colorado?

- How can you save money while still enjoying everything that Colorado has to offer?

- Tips for budgeting and managing your finances while living in Colorado

- Exploring some affordable neighborhoods and cities in Colorado

Is Colorado an affordable place to live?

When exploring the cost of living in Colorado, it is crucial to consider your income level. According to a recent study by the Economic Policy Institute, the cost of living in Colorado is higher than the national average. However, the state offers a competitive job market with a low unemployment rate, indicating that the higher cost of living is offset by better-paying jobs.

Additionally, Colorado has a variety of affordable housing options, including apartments, townhomes, and single-family homes. The state also offers various programs and incentives for first-time homebuyers, making it easier to purchase a home. Furthermore, Colorado has a lower tax burden compared to other states, which can help offset the higher cost of living.

Examining the various factors that contribute to the cost of living in Colorado

Housing, groceries, transportation, utilities, taxes, healthcare expenses and income level play a significant role in calculating the overall cost of living in Colorado.

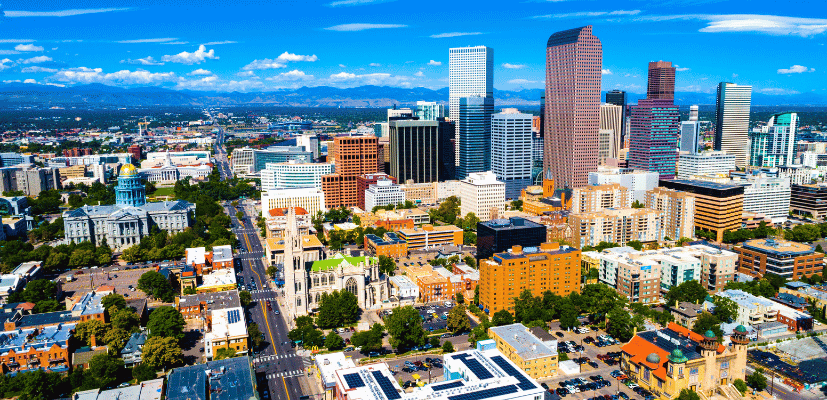

One of the major factors that contribute to the cost of living in Colorado is housing. The state has experienced a significant increase in housing prices over the past few years, especially in urban areas like Denver and Boulder. This has made it difficult for many residents to afford decent housing, leading to an increase in homelessness and overcrowding in some areas.

Another factor that affects the cost of living in Colorado is healthcare expenses. The state has some of the highest healthcare costs in the country, which can be attributed to a number of factors, including a high number of uninsured residents, a shortage of healthcare providers in some areas, and the high cost of medical procedures and prescription drugs.

The impact of housing costs on the overall cost of living in Colorado

When it comes to housing costs, Colorado is one of the most expensive states in the country. The average home price in Colorado is $519,000, nearly double the U.S. average. This results in higher property taxes and homeowner insurance rates, making owning a home in Colorado costlier than renting.

Furthermore, the high housing costs in Colorado also affect the rental market. Rent prices in Colorado are also higher than the national average, with the average rent for a one-bedroom apartment in Denver being around $1,500 per month. This makes it difficult for renters to save money and afford other expenses, such as healthcare and transportation.

Additionally, the high housing costs in Colorado have a ripple effect on the state’s economy. Many businesses struggle to attract and retain employees due to the high cost of living, which can lead to a shortage of skilled workers. This can ultimately impact the state’s economic growth and development.

How does the cost of food and groceries in Colorado compare to other states?

Colorado has a reputation for its organic food and local cuisine, but it comes at a cost. The cost of groceries in Colorado is higher than the national average, mainly because of higher transportation and storage costs. However, residents can save money by purchasing locally grown seasonal produce, shopping at discount stores and meal planning.

Despite the higher cost of groceries in Colorado, the state has a thriving food scene with a variety of options for all budgets. From food trucks to high-end restaurants, Colorado offers a diverse range of cuisines and dining experiences. Additionally, many cities in Colorado have farmers markets where residents can purchase fresh produce directly from local farmers.

It’s also worth noting that the cost of groceries can vary within Colorado itself. For example, groceries in Denver may be more expensive than in smaller towns or rural areas. It’s important for residents to compare prices and shop around to find the best deals. Overall, while the cost of food and groceries in Colorado may be higher than in some other states, there are still ways to save money and enjoy the local food culture.

Transportation costs: Can you save money by using public transport in Colorado?

Colorado’s transportation costs are relatively low compared to other states, but this primarily depends on where you live and how often you need to commute. Denver has a well-connected public transportation system while smaller cities and towns might not have public transit at all. Living closer to your workplace can lower transportation costs while also reducing your carbon footprint.

Additionally, Colorado offers various discounts and incentives for using public transportation. The EcoPass program, for example, provides unlimited access to buses and light rail services for employees of participating companies. The program not only saves money for commuters but also reduces traffic congestion and air pollution. Furthermore, the Regional Transportation District (RTD) offers discounted fares for seniors, students, and individuals with disabilities. By taking advantage of these programs, you can save money and contribute to a more sustainable future.

Also read: Cost of living in Maryland

Utilities and energy costs: What you need to know before moving to Colorado

Utilities in Colorado can be costly, especially during the winter months, when energy usage for heating spikes. However, many energy-efficient homes and apartments use renewable energy sources such as solar and wind energy, which can save money on energy bills in the long-term.

It is important to note that Colorado has a deregulated energy market, which means that residents have the option to choose their energy provider. This can lead to competitive pricing and potentially lower energy costs. Additionally, some utility companies offer programs and incentives for energy-efficient upgrades, such as installing insulation or upgrading to Energy Star appliances.

When it comes to water utilities, Colorado is known for its strict water conservation policies. Residents are encouraged to conserve water through measures such as low-flow showerheads and toilets, and some cities have implemented tiered pricing systems to incentivize water conservation. It is important to research the specific water policies and regulations in the area you are considering moving to, as they can vary by city and county.

Taxes in Colorado: An overview of how they affect the cost of living

Colorado’s state income tax rate is a flat 4.63%, which is lower than average compared to other states. However, the local sales tax rate can be as high as 11.2%. Property taxes vary based on county and city, but it is typically lower than other states.

It is important to note that Colorado also has a special tax on marijuana sales, which is currently set at 15%. This tax revenue is used to fund public schools, health care, and other public services. Additionally, Colorado offers a homestead exemption for senior citizens, which can provide significant property tax relief for those who qualify.

Overall, while Colorado’s tax rates may vary depending on the type of tax and location, the state generally has a lower tax burden compared to other states. This can make it an attractive place to live for those looking to save money on taxes and reduce their cost of living.

Healthcare expenses: Are they higher or lower than the national average?

Healthcare expenses in Colorado can be higher than the national average, but healthcare quality is excellent. Some residents opt to buy health insurance through Colorado’s Connect for Health insurance marketplace to save money. Additionally, choosing a health care provider that accepts your insurance can lower healthcare costs.

It is important to note that healthcare expenses can vary greatly depending on the specific region of Colorado. For example, healthcare costs in Denver may be higher than in rural areas. It is recommended to research and compare healthcare costs in different regions before making a decision on where to receive medical care.

Another factor that can impact healthcare expenses is the type of medical procedure or treatment needed. Some procedures may be more expensive in Colorado than in other states, while others may be more affordable. It is important to discuss all options with your healthcare provider and insurance company to determine the most cost-effective solution.

Understanding how your income level affects your cost of living in Colorado

While Colorado’s high cost of living can be challenging, living expenses can be manageable for residents with a higher income. Residents with a lower income may struggle to afford rent and childcare costs, making living in certain areas such as Denver and Boulder unaffordable.

It’s important to note that the cost of living in Colorado varies depending on the region. For example, living expenses in rural areas tend to be lower than in urban areas. Additionally, certain neighborhoods within cities may have lower living expenses than others. It’s important to research and compare the cost of living in different areas before deciding where to live.

Another factor to consider is the state’s tax system. Colorado has a flat income tax rate of 4.55%, which means that residents with higher incomes may pay a larger portion of their income in taxes. However, the state does not have a sales tax on food, which can help lower living expenses for all residents.

Cost comparisons between major cities in Colorado

It is essential to consider the cost of living in different cities and towns in Colorado when choosing your new home. According to the Bureau of Economic Analysis, Boulder and Denver rank higher in cost of living, and Colorado Springs and Grand Junction rank lower.

Why do some people find it difficult to afford living in Colorado?

The high cost of living in Colorado is a result of various factors, such as the demand for housing, tourism, and natural resources. Additionally, Colorado’s rapid population growth in recent years has led to a shortage of affordable housing.

How can you save money while still enjoying everything that Colorado has to offer?

Colorado offers free or low-cost activities throughout the year, such as hiking, camping, and bike trails. Additionally, local festivals and events are often free or low cost. Planning ahead for meals and utilizing public transportation can help save money on living expenses.

Tips for budgeting and managing your finances while living in Colorado

Creating a budget is essential when living in a high-cost state like Colorado. Some tips for budgeting include setting financial goals, tracking monthly expenses, cutting back on subscriptions or memberships, and identifying areas where you can save money, such as grocery shopping and utilities.

Exploring some affordable neighborhoods and cities in Colorado

While some neighborhoods in Colorado can be expensive, several affordable areas offer lower living expenses. Some affordable cities and towns to consider include Pueblo, Monte Vista, Trinidad, and Alamosa.

In conclusion, the high cost of living in Colorado can be challenging, but it is not impossible to overcome. By considering various factors such as income level, location, and budgeting, residents can manage living expenses while still enjoying the state’s natural beauty and diverse activities.