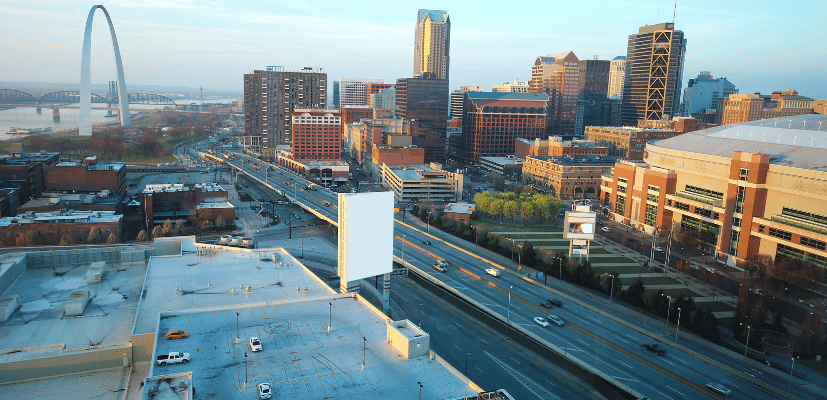

Saint Louis, located in the heart of the midwestern United States is one of the most popular metropolitan areas in the state of Missouri. People move to this city for various reasons, be it for studying or work opportunities or to experience the rich cultural heritage it has to offer. However, before deciding to call it home, one must consider the cost of living in the city. This article explores various aspects of the cost of living in St. Louis and helps you understand how it compares to other cities in the United States.

- The Cost of Utilities in St. Louis Compared to Other Cities

- Understanding the Transportation Costs in St. Louis

- How St. Louis Compares to Other Cities in Terms of Grocery Costs

- The Cost of Healthcare in St. Louis: What You Need to Know

- Exploring the Entertainment and Dining Costs in St. Louis

- Finding Affordable Schools and Daycares in St. Louis

- The Overall Cost of Living Index for St. Louis: How it Compares to Other Cities

- Tips for Saving Money While Living in St. Louis

- Exploring Different Neighborhoods and Their Cost of Living

- The Pros and Cons of Living in St. Louis Based on the Cost of Living

- Understanding the Income Tax Rates and Property Taxes in St.Louis

- Comparing the Cost of Living Between Downtown and Suburban Areas

- What Factors Affect the Cost of Living in St.Louis?

- Conclusion

The Cost of Utilities in St. Louis Compared to Other Cities

Utilities are a basic necessity that one cannot compromise on. If you are planning to move to St. Louis, it’s important to know how much you would be spending on utility bills. On average, a family of four living in a 2-3 bedroom apartment in St. Louis would pay around $150 per month for electricity, water, and gas combined. This rate is relatively lower than other major cities in the US, such as New York, Los Angeles, or San Francisco. However, one can still save more on utility expenses by making some changes, such as switching to energy-efficient light bulbs or using smart home devices to control energy usage.

It’s worth noting that the cost of utilities in St. Louis can vary depending on the season. During the summer months, when air conditioning usage is high, electricity bills can increase significantly. Similarly, during the winter months, gas bills may be higher due to increased heating needs. It’s important to factor in these seasonal variations when budgeting for utility expenses in St. Louis.

Understanding the Transportation Costs in St. Louis

Transportation expenses are often overlooked when calculating the cost of living. In St. Louis, the transportation cost mainly depends on the distance between your home and workplace, and the mode of transport you choose. A one-way ticket for public transportation in St. Louis costs around $2.50, while a monthly pass costs around $78. If you own a car, you would need to factor in expenses such as gas, insurance, parking, and maintenance costs. It’s recommended to compare the costs of public transportation versus driving before making a decision.

Another factor to consider when calculating transportation costs in St. Louis is rush hour traffic. If you choose to drive during peak hours, you may spend more time in traffic, which can increase your fuel expenses and add to the wear and tear on your vehicle. Additionally, parking in downtown St. Louis can be expensive, with rates ranging from $10 to $20 per day. It’s important to factor in these additional costs when deciding on your mode of transportation.

St. Louis also offers alternative modes of transportation, such as biking and walking. The city has a growing network of bike lanes and trails, making it easy to commute by bike. Additionally, many neighborhoods in St. Louis are pedestrian-friendly, with sidewalks and crosswalks making it safe and convenient to walk to work or run errands. Choosing these alternative modes of transportation can not only save you money, but also provide health benefits and reduce your carbon footprint.

How St. Louis Compares to Other Cities in Terms of Grocery Costs

Grocery costs can vary significantly between cities. In St. Louis, the cost of groceries for a family of four is around $600 per month, whereas in New York or Los Angeles, it could add up to $1000 or more. St. Louis has a good mix of affordable and high-end grocery stores, so one can choose a store and purchase according to their budget.

However, it’s important to note that the cost of groceries can also vary within a city. For example, certain neighborhoods in St. Louis may have higher prices due to limited grocery store options or higher demand. It’s always a good idea to compare prices and shop around to find the best deals.

Additionally, St. Louis has a strong local food scene, with many farmers markets and community-supported agriculture programs. These options not only support local farmers and businesses, but can also provide fresher and more affordable produce options for consumers.

The Cost of Healthcare in St. Louis: What You Need to Know

When it comes to healthcare, St. Louis has some of the top-ranked hospitals in the state of Missouri. The cost of medical treatment, however, can significantly impact your budget. For example, an outpatient visit to a doctor would cost around $200, while a health insurance plan for a family of four would cost around $1200 per month on average. To save on healthcare-related expenses, consider getting an employer-sponsored healthcare plan or a health savings account (HSA).

It’s important to note that the cost of healthcare in St. Louis can vary depending on the type of treatment needed. For instance, a visit to the emergency room can cost upwards of $1000, while a routine check-up with a primary care physician may only cost $100. Additionally, the cost of prescription medication can also add up quickly, with some medications costing hundreds or even thousands of dollars per month.

One way to potentially save on healthcare costs is to take advantage of community health clinics, which offer low-cost or free medical services to those who qualify. These clinics may offer services such as preventative care, dental care, and mental health services. It’s also worth exploring telemedicine options, which allow patients to consult with healthcare providers remotely, often at a lower cost than an in-person visit.

Also read: Cost of living in Alabama

Exploring the Entertainment and Dining Costs in St. Louis

St. Louis has plenty of entertainment options, and its dining scene is one of the best in the Midwest. On average, a dinner for two in a mid-range restaurant would cost around $60, while a movie ticket costs around $12. If you are looking to enjoy luxurious experiences, such as fine dining or premium seats at sporting events, you may need to shell out a bit more. However, there are also plenty of free entertainment options available, such as visiting art galleries or attending festivals.

Finding Affordable Schools and Daycares in St. Louis

If you have kids, then education and daycare are some of the essential expenses to consider. In St. Louis, tuition fees for private schools can range from $10,000 to $20,000 per year. However, there are also plenty of affordable public schools available. Childcare expenses for a family of four with two kids range from $900 to $1400 per month, depending on the facility and services offered. It’s important to explore different options and compare costs before making a decision.

The Overall Cost of Living Index for St. Louis: How it Compares to Other Cities

The cost of living index is a measure that considers the average expenses of a household in a city compared to the national average. In St. Louis, the cost of living index is around 88, which is lower than the national average of 100. This means that you could save money on everyday expenses if you choose to live in St. Louis compared to other major US cities such as New York, San Francisco, or Boston. However, it’s important to note that the cost of living can vary significantly depending on your lifestyle and budget.

Tips for Saving Money While Living in St. Louis

Living economically doesn’t mean compromising on quality of life. Here are some tips to help you save money while living in St. Louis:

- Look for affordable housing options and choose a location close to your workplace to reduce transportation costs.

- Buy groceries in bulk or in-season produce to save on grocery expenses.

- Avoid unnecessary expenses by utilizing free and low-cost entertainment options.

- Consider carpooling or using public transportation to reduce transportation expenses.

By making small changes, you can save a significant amount of money in the long run.

Exploring Different Neighborhoods and Their Cost of Living

St. Louis has a vibrant range of neighborhoods, each having its own unique character, charm, and price tag. For example, the average rent for a one-bedroom apartment in Downtown St. Louis is around $1400, whereas in the nearby neighborhood of Lafayette Square, it’s around $1000. Similarly, the cost of living in the affluent neighborhood of Clayton is higher than that of the diverse and multicultural area of Tower Grove. It’s important to research neighborhoods and their rental rates before making a housing decision.

The Pros and Cons of Living in St. Louis Based on the Cost of Living

Overall, St. Louis is a relatively affordable city to live in compared to other major US cities. However, like any city, it has its advantages and disadvantages. Here are some of the pros and cons of living in St. Louis based on the cost of living:

- Pros:

- The overall cost of living is lower than other major US cities.

- The city has a diverse range of affordable housing options.

- There are plenty of free and low-cost entertainment options available in the city.

- Cons:

- The city has a higher poverty rate compared to the national average.

- The crime rate in St. Louis is relatively high, especially in certain neighborhoods.

- The city experiences extremely hot and humid summers, which can increase utility expenses.

It’s important to weigh the pros and cons before deciding to call St. Louis home.

Understanding the Income Tax Rates and Property Taxes in St.Louis

The amount of taxes you pay can significantly impact your budget. In St. Louis, the income tax rate ranges between 1.5% to 6%, depending on your income level. Property tax rates, on the other hand, range from 1% to 3%, depending on the location and value of your property. Understanding the tax rates and budgeting for them is essential to avoid financial burdens.

Comparing the Cost of Living Between Downtown and Suburban Areas

The cost of living index, housing rates, and transportation costs in downtown St. Louis are relatively higher than suburban areas. However, living in downtown can also provide the convenience of being close to work, entertainment venues, and public transportation. Suburban areas may have lower housing rates and taxes, but higher transportation costs and a lesser variety of entertainment options. It’s important to evaluate the advantages and disadvantages of each area before deciding on where to live.

What Factors Affect the Cost of Living in St.Louis?

The cost of living in St. Louis is affected by various factors, such as:

- Household income

- Choice of housing and neighborhood

- Transportation expenses

- Food and grocery expenses

- Healthcare expenses

- Entertainment and lifestyle choices

Awareness and understanding of these factors can help you make informed decisions about living in St. Louis.

Conclusion

In conclusion, St. Louis offers a relatively affordable cost of living compared to other major US cities. Understanding the different factors that affect the cost of living, such as housing rates, transportation costs, and healthcare expenses, is crucial in determining the budget in St. Louis. While the city has plenty of advantages, such as a diverse range of affordable housing options and free entertainment options, it also has its disadvantages, such as a higher poverty rate and crime rate in certain neighborhoods. By considering all these factors and tips for saving money, one can make a well-informed decision about moving to St. Louis.