If you’re considering moving to Virginia, it’s important to understand the cost of living before packing up and making the move. Virginia is a beautiful and diverse state, with thriving urban centers, quaint smaller towns, and everything in between. However, the cost of living in Virginia can vary depending on numerous factors, such as housing costs, average salary, taxes, healthcare, and transportation expenses.

- Factors That Affect the Cost of Living in Virginia

- Housing Costs in Virginia: Renting Vs. Owning

- The Average Salary in Virginia and Its Impact on Cost of Living

- Taxes in Virginia: How They Affect Your Cost of Living

- The Cost of Healthcare in Virginia and How to Manage It

- Transportation Costs in Virginia: Getting Around on a Budget

- Food and Grocery Costs in Virginia: Tips for Saving Money

- Entertainment and Recreation Expenses in Virginia: How to Budget

- Best Places to Live in Virginia Based on Affordability and Quality of Life

- Managing Your Finances While Living in Virginia: Tips and Tricks

- Comparison of the Cost of Living in Major Cities Across Virginia

Factors That Affect the Cost of Living in Virginia

When considering the cost of living in Virginia, it’s important to understand the factors that contribute to it. The cost of living is affected by many things, such as housing costs, taxes, healthcare expenses, utility charges, and transportation costs. Additionally, the cost of living varies from city to city, with some areas being more affordable than others. By understanding these factors, you can make an informed decision about the cost of living in Virginia and whether it’s the right choice for you.

One factor that can significantly affect the cost of living in Virginia is the state’s economy. Virginia has a diverse economy, with industries such as agriculture, manufacturing, and technology. The strength of the economy can impact the cost of living, as it affects job availability and wages. In areas with a strong economy and high demand for workers, the cost of living may be higher due to increased competition for housing and other necessities. On the other hand, areas with a weaker economy may have a lower cost of living, but job opportunities and wages may also be limited. It’s important to consider the state’s economy when evaluating the cost of living in Virginia.

Housing Costs in Virginia: Renting Vs. Owning

Housing costs are a significant factor in the cost of living in Virginia, and there are pros and cons to both renting and owning. According to data from Zillow, the median home price in Virginia is $310,633, which is higher than the national average. However, there are many affordable housing options available in Virginia, and with a little research and patience, it’s possible to find a home or apartment that fits your budget. Choosing between renting and buying typically depends on your long-term goals, financial situation, and personal preferences. As a renter, you’ll have lower upfront costs and more flexibility, while homeownership can provide long-term financial stability and potential for investment gains.

It’s important to consider additional costs beyond the initial purchase or rental price when deciding between renting and owning in Virginia. Homeowners will need to budget for property taxes, homeowners insurance, and maintenance costs, while renters may face additional fees such as security deposits and pet fees. It’s also worth noting that Virginia has a relatively high property tax rate compared to other states, which can significantly impact the overall cost of homeownership. Ultimately, it’s important to carefully weigh the pros and cons of each option and consider your long-term financial goals before making a decision.

Also read: Cost of living in Cambridge

The Average Salary in Virginia and Its Impact on Cost of Living

The average salary in Virginia is above the national average, according to data from the Bureau of Labor Statistics. However, the cost of living in some areas of the state is higher than others. For example, Northern Virginia has a higher cost of living than central or southern Virginia due to a higher concentration of high-paying jobs. When deciding where to live in Virginia, it’s important to consider the average salary for your profession, as well as the cost of living in the area, to ensure that you can maintain a comfortable standard of living.

Additionally, it’s worth noting that the average salary in Virginia varies by industry. For example, the technology sector in Northern Virginia offers some of the highest salaries in the state, while the healthcare industry is a major employer in central Virginia. It’s important to research the average salaries for your specific industry and job title when considering a move to Virginia. This information can help you negotiate a fair salary and ensure that you’re able to afford the cost of living in your desired area.

Taxes in Virginia: How They Affect Your Cost of Living

Taxes are an important consideration when determining the cost of living in Virginia. Virginia has a progressive income tax system with a top rate of 5.75%, which is relatively low compared to other states. However, property taxes can be steep in some areas of the state, and sales tax can range from 5.3% to 7%, depending on the locality. When factoring in taxes, it’s important to consider both state and local taxes, as they can vary greatly from one area to another.

Additionally, Virginia offers several tax credits and deductions that can help offset the cost of living. For example, the state offers a tax credit for low-income families who rent their homes, as well as a tax credit for those who purchase energy-efficient appliances. Virginia also has a homestead exemption for homeowners over the age of 65, which can reduce their property tax burden. It’s important to research and take advantage of these tax benefits to help lower your overall cost of living in Virginia.

The Cost of Healthcare in Virginia and How to Manage It

Healthcare expenses are a significant consideration when determining the cost of living in Virginia. The cost of healthcare can vary depending on your age, health, and insurance coverage. Virginia has many leading healthcare providers, such as Inova Health System, Sentara Healthcare, and Bon Secours Health System, but costs can still be significant. To better manage healthcare expenses, it’s important to maintain good health, shop around for the best healthcare providers and insurance plans, and take advantage of programs such as Medicaid or Medicare.

Additionally, Virginia has several community health clinics that offer affordable healthcare services to those who may not have insurance or have limited access to healthcare. These clinics provide a range of services, including primary care, dental care, and mental health services. Some of the community health clinics in Virginia include the Virginia Community Healthcare Association, the Free Clinic of Central Virginia, and the Harrisonburg-Rockingham Free Clinic. By utilizing these resources, individuals can receive quality healthcare at a lower cost.

Transportation Costs in Virginia: Getting Around on a Budget

Transportation expenses can also vary depending on where you live in Virginia. For example, the cost of public transportation may be higher in Northern Virginia due to a greater need for it. Additionally, gas prices, car insurance, and car maintenance can all contribute to transportation costs. To save money on transportation, you can take advantage of public transportation, carpool, bike, or walk whenever possible. It’s also important to consider the cost of transportation when choosing where to live in Virginia, as proximity to work, school, and amenities can significantly impact transportation costs.

Another factor to consider when it comes to transportation costs in Virginia is the time of year. During the winter months, snow and ice can make driving more difficult and increase the likelihood of accidents, which can lead to higher car insurance rates. Additionally, if you live in a rural area, you may need to budget for additional expenses such as snow tires or a four-wheel drive vehicle to navigate the roads during the winter.

Finally, it’s important to be aware of any tolls or fees associated with using certain roads or bridges in Virginia. For example, if you frequently travel across the Chesapeake Bay Bridge-Tunnel, you will need to budget for the tolls. Similarly, if you commute to Washington D.C. for work, you may need to pay tolls on the Dulles Toll Road or the 495 Express Lanes. By factoring in these additional costs, you can better plan your transportation budget and avoid any unexpected expenses.

Food and Grocery Costs in Virginia: Tips for Saving Money

Food and grocery costs are essential expenses that can significantly impact the cost of living in Virginia. There are many ways to save money on food and groceries, such as preparing meals at home, buying generic brands, and shopping at discount retailers. Additionally, Virginia has many farmers markets and other options for locally sourced and fresh produce, which can help you save money while also supporting local businesses.

Entertainment and Recreation Expenses in Virginia: How to Budget

Entertainment and recreation are important for maintaining a healthy lifestyle and getting the most out of your time in Virginia. However, these expenses can add up quickly and significantly impact the cost of living. There are many affordable options for entertainment and recreation in Virginia, such as hiking, biking, visiting museums, and attending free events. It’s important to budget for these expenses to ensure that they don’t overshadow other essential expenses, such as housing and healthcare.

Best Places to Live in Virginia Based on Affordability and Quality of Life

Virginia offers many great places to live, but some areas are more affordable than others. When considering where to live in Virginia, it’s important to balance affordability with quality of life. Some of the most affordable places to live in Virginia include Roanoke, Lynchburg, and Danville. These areas offer affordable housing options and access to amenities, such as shopping, dining, and recreation. Additionally, they have lower crime rates and a slower pace of life than some of Virginia’s larger cities.

Managing Your Finances While Living in Virginia: Tips and Tricks

Managing your finances is essential to living a comfortable and fulfilling life in Virginia. To manage your finances effectively, it’s important to create a budget, plan for unexpected expenses, and save for long-term goals, such as retirement or a down payment on a home. Virginia offers many resources for financial education and assistance, such as credit counseling and savings programs. By taking advantage of these resources and following good financial habits, you can maintain a comfortable standard of living in Virginia.

Comparison of the Cost of Living in Major Cities Across Virginia

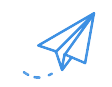

Virginia has many great cities to live in, but the cost of living can vary greatly depending on the area. Northern Virginia, which includes cities such as Arlington, Alexandria, and Fairfax, is one of the most expensive areas in the state due to its proximity to Washington D.C. Richmond and Virginia Beach are also popular cities to live in, but they have different costs of living. To determine which city is right for you, it’s important to consider both the cost of living and your personal preferences for lifestyle and amenities.

In conclusion, Virginia offers many options for affordable and comfortable living. It’s important to consider all of the factors that contribute to the cost of living, such as housing costs, taxes, healthcare expenses, transportation costs, and entertainment expenses. Whether you’re considering renting or buying, living in a big city or a smaller town, or planning for long-term financial goals, there are many resources and options available to help you make the most of your life in Virginia.