North Dakota, located in the northern midwestern region of the United States, has become an increasingly popular destination for both individuals and families looking for an escape from the hectic and expensive lifestyle of big cities. Living in North Dakota offers a unique combination of beautiful landscapes, friendly people, and a cost of living that is much lower than other states in the country. In this article, we’ll provide you with an overview of the cost of living in North Dakota and how it compares to other states, as well as tips for saving money while living there.

- The Average Cost of Renting a Home in North Dakota

- How Much Does it Cost to Buy a House in North Dakota?

- The Cost of Utilities in North Dakota Compared to Other States

- Understanding Property Taxes and Homeowners Insurance Rates in North Dakota

- The Average Cost of Food and Groceries in North Dakota

- Transportation Costs: Gas Prices, Car Insurance and Registration Fees in North Dakota

- Healthcare Costs: Medical Insurance and Out-of-Pocket Expenses in North Dakota

- The Cost of Education: Tuition Fees, Books, and Supplies in North Dakota

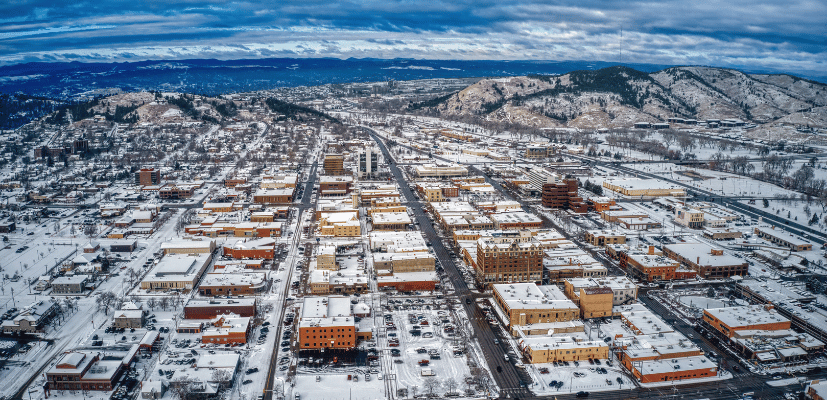

- Comparing the Cost of Living in Major Cities vs Rural Areas in North Dakota

- The Impact of the Oil Industry on the Cost of Living in North Dakota

- Tips for Saving Money While Living in North Dakota

- The Pros and Cons of Living in North Dakota Based on Its Cost of Living

- How Does the Cost of Living in North Dakota Compare to Other States?

- Future Outlook for the Cost of Living in North Dakota

The Average Cost of Renting a Home in North Dakota

One of the most significant expenses people face when moving to North Dakota is housing. The average cost of renting a one-bedroom apartment in the state is around $700 per month, while a two-bedroom apartment typically costs around $950. The cost of renting a home varies depending on the location, with larger cities being more expensive. For instance, in Fargo, the largest city in North Dakota, a one-bedroom apartment costs around $850 per month, while a two-bedroom apartment costs roughly $1,100.

It’s worth noting that the cost of utilities is not typically included in the monthly rent in North Dakota. This means that renters will need to budget for additional expenses such as electricity, gas, and water. On average, residents of North Dakota can expect to pay around $150 per month for utilities, although this can vary depending on the size of the home and the time of year.

How Much Does it Cost to Buy a House in North Dakota?

The average cost of buying a house in North Dakota is around $214,000. However, like renting, the price of a home in the state varies depending on the location. Homes in the larger cities like Fargo, Bismarck, and Grand Forks are more expensive, while homes in the rural areas are much more affordable. The cost of a home in Fargo, for instance, is around $238,000, while in Bismarck, the average cost is $295,000. In contrast, in smaller towns like Rugby and Lisbon, the average cost of a home is under $200,000.

It’s important to note that the cost of a home in North Dakota not only varies by location, but also by the type of home. Single-family homes tend to be more expensive than townhouses or condos. Additionally, the age and condition of the home can also impact its price. Newly built homes or those that have been recently renovated may have a higher price tag than older homes in need of repairs. It’s important to consider all of these factors when searching for a home in North Dakota.

The Cost of Utilities in North Dakota Compared to Other States

North Dakota’s utility costs are more reasonable when compared to the rest of the nation. For example, the average monthly cost of electricity in North Dakota is $108, compared to the national average of $117. The average gas bill runs around $72 per month, compared to the national average of $73. Water and sewer fees also run less in North Dakota, at an average of around $70 per month, compared to the national average of $80.

One of the reasons for North Dakota’s lower utility costs is its abundance of natural resources. The state is a major producer of coal, oil, and natural gas, which helps keep energy costs down. Additionally, North Dakota has invested in renewable energy sources, such as wind power, which has also contributed to lower utility costs for residents.

Understanding Property Taxes and Homeowners Insurance Rates in North Dakota

When purchasing a home in North Dakota, it’s essential to also consider the costs associated with property taxes and homeowners insurance rates. The average property tax rate in North Dakota is around 1.43%, which is lower than the national average. Homeowners insurance rates in North Dakota are also lower than the national average, with an average annual premium of around $1,000.

It’s important to note that property taxes in North Dakota are based on the assessed value of the property. This means that if the value of your home increases, your property taxes will likely increase as well. However, North Dakota does offer property tax exemptions for certain groups, such as disabled veterans and senior citizens.

When it comes to homeowners insurance rates, it’s important to shop around and compare quotes from different insurance providers. Factors that can affect your homeowners insurance rates in North Dakota include the age and condition of your home, the location of your home, and your credit score. Additionally, some insurance providers may offer discounts for things like having a security system or bundling your home and auto insurance policies.

Also read: Cost of living in Oakland

The Average Cost of Food and Groceries in North Dakota

North Dakota ranks 13th in the nation for food affordability. The average cost of groceries in North Dakota is around 9% lower than the national average. For instance, a gallon of milk in North Dakota costs around $2.80, compared to the national average of $3.15. A loaf of bread costs roughly $2.67, compared to the national average of $2.86. Meanwhile, dining out in larger cities can be more expensive, with the average cost of a meal for two at a mid-range restaurant coming to around $50.

It’s worth noting that the cost of food and groceries in North Dakota can vary depending on the season. During the winter months, when many fresh produce items are not in season, prices may be slightly higher. However, North Dakota is known for its agriculture industry, and during the summer months, locally grown fruits and vegetables can be found at farmers markets and roadside stands at very reasonable prices.

In addition to the affordability of groceries, North Dakota also has a strong food culture, with many unique and delicious regional dishes. Some popular dishes include knoephla soup, lefse, and chokecherry jelly. Visitors to North Dakota can also enjoy bison burgers, a nod to the state’s history as a hub for bison hunting and ranching.

Transportation Costs: Gas Prices, Car Insurance and Registration Fees in North Dakota

Transportation costs in North Dakota can vary based on the location and the type of vehicle you own. North Dakota has lower fuel prices compared to other states, with the average cost of a gallon of gas being around $2.30. Car insurance rates in North Dakota are generally lower than the national average, with the average annual premium being around $1,200. Vehicle registration fees are also affordable, with a typical passenger vehicle registration costing around $49 per year.

It is important to note that transportation costs may also be affected by the condition of the roads in North Dakota. Due to harsh winter weather conditions, roads can become damaged and require frequent repairs. This can lead to increased maintenance costs for vehicle owners, such as tire replacements and alignments. Additionally, some rural areas may have limited public transportation options, which can result in higher transportation costs for those who rely on personal vehicles for daily commuting.

Healthcare Costs: Medical Insurance and Out-of-Pocket Expenses in North Dakota

Healthcare costs in North Dakota are more reasonable compared to other states. The average cost of medical insurance for a family of four in North Dakota is around $1,557 per month, which is below the national average. Out-of-pocket expenses are also more affordable, with an average insurance deductible of around $2,900.

The Cost of Education: Tuition Fees, Books, and Supplies in North Dakota

The cost of education can vary depending on the level of education and type of institution. The average cost of in-state tuition and fees per year for a four-year public university in North Dakota is around $8,600, while the average cost of attending a two-year public college is around $5,000. Private universities can be more expensive, with tuition and fees averaging around $20,000 per year. Books and supplies add an additional cost of roughly $1,000 per year.

Comparing the Cost of Living in Major Cities vs Rural Areas in North Dakota

Living in rural areas in North Dakota is generally less expensive compared to the larger cities, mainly due to the lower cost of housing and food. However, larger cities have more job opportunities and access to more amenities, such as restaurants, entertainment, shopping, and healthcare. It’s essential to weigh the pros and cons of each location before making a decision based on the cost of living.

The Impact of the Oil Industry on the Cost of Living in North Dakota

In recent years, the oil industry has had a significant impact on North Dakota’s economy and cost of living. The oil boom has brought an influx of new jobs and workers to the state, which has driven up the cost of housing and other expenses. While the oil industry has provided opportunities for growth, it’s essential to be aware of the potential risks and costs associated with it.

Tips for Saving Money While Living in North Dakota

There are various ways to save money while living in North Dakota. One of the most significant expenses is housing, so consider living with roommates or in a smaller town to save on rent or mortgage payments. Cooking and eating at home rather than dining out regularly can also help save money on food. Additionally, using public transportation or carpooling, reducing energy usage, and taking advantage of free or low-cost entertainment options can help you keep costs down.

The Pros and Cons of Living in North Dakota Based on Its Cost of Living

North Dakota’s low cost of living has many benefits, including a higher standard of living, access to affordable housing, and a lower stress lifestyle. However, it’s essential to consider the potential trade-offs, such as a limited job market and harsh winters. Additionally, while living in rural areas may be more affordable, it can also lead to a lack of access to amenities like healthcare and entertainment options.

How Does the Cost of Living in North Dakota Compare to Other States?

Overall, North Dakota’s cost of living is lower than the national average. Compared to neighboring states like Minnesota and South Dakota, North Dakota’s housing, utilities, and transportation costs are more affordable. However, the state’s healthcare and education costs are slightly higher than the national average. It’s essential to consider these factors before making a decision on where to live.

Future Outlook for the Cost of Living in North Dakota

It is difficult to predict the future cost of living in North Dakota, as it will depend on various factors, such as the state’s economic growth and changes in industry and population. However, with its current low cost of living, North Dakota offers an attractive option for those looking for an affordable place to call home.